Overview: Why GST Was Introduced

Before GST, India’s indirect tax system comprised multiple central and state levies — VAT, excise, service tax, octroi and more. These overlapping taxes led to a cascading tax-on-tax effect, compliance complexity and friction in interstate trade. GST replaced many of these levies with a value-added system that applies tax only on net value addition at each stage, making structured GST Registration the first essential step for businesses entering the new tax framework.

Key objectives

- Eliminate cascading taxes

- Create one national market

- Promote transparency and formalization

GST Components

GST comprises CGST (central), SGST (state) and IGST (interstate). Rates are applied depending on the nature of the supply and the transaction.

Transformational gains

Unified compliance, fewer checkpoints, and the availability of input tax credits make the supply chain more efficient.

Broad Impacts of GST

GST’s introduction reshaped several business practices. The most visible changes include a stronger focus on digital compliance, a greater need for accurate invoicing, and improved transparency of tax components for consumers. These changes also increased the importance of timely GST Return filing to keep records accurate and compliant.

Input Tax Credit & Cash Flow

Seamless Input Tax Credit (ITC) across the supply chain is a major benefit — businesses can claim credit for taxes paid on inputs, reducing the effective tax burden. However, ITC depends on timely reporting and invoice matching between suppliers and recipients; mismatches can block credits and cause temporary liquidity stress.

Technology & Compliance

GST accelerated adoption of accounting software, e-invoicing (based on turnover thresholds), and digital filing systems. While technology has eased some processes, it also required investment in systems and staff training, especially for smaller enterprises.

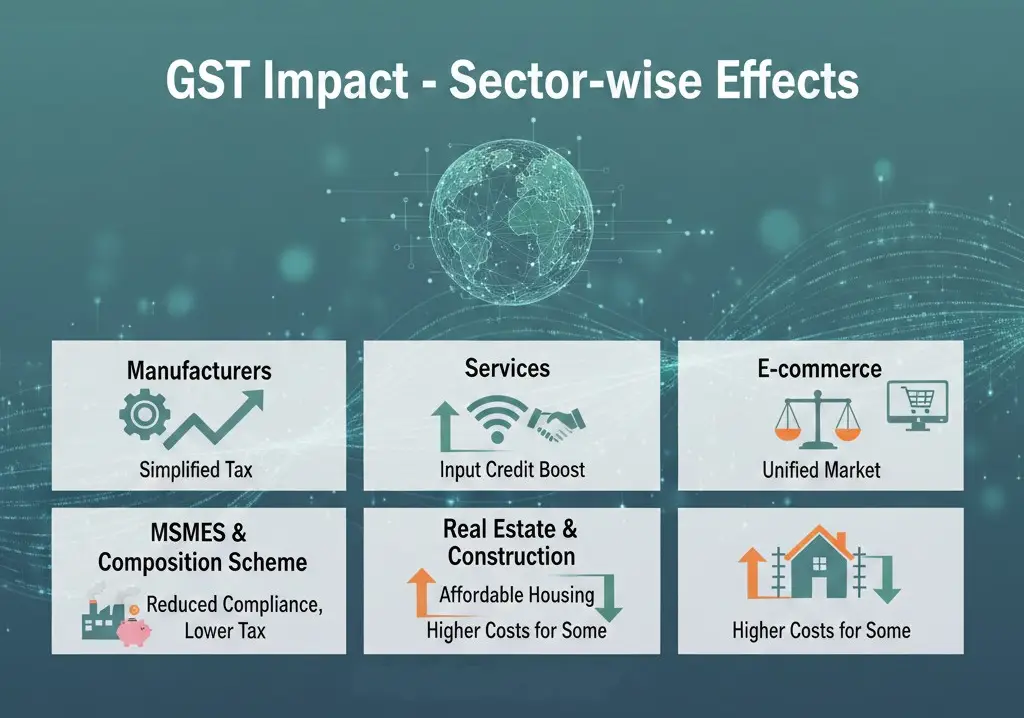

Sector-wise Effects

The impact of GST varies by industry. Below are key sector-specific changes and implications:

Pros & Cons — A Balanced View

Positive Outcomes

- Unified national market — easier interstate trade

- Reduction in cascading taxes and better price discovery

- Improved compliance and higher tax base

- Greater adoption of digital record-keeping

Challenges & Downsides

- Higher compliance load and monthly reconciliation

- Initial technical issues with the GST portal

- Credit blockage due to mismatch in supplier invoices

- Transition pain for unorganized and cash-based sectors

Compliance, Reporting & Best Practices

GST compliance demands accurate books, timely filings and coordination with suppliers. The following best practices reduce risks and streamline GST operations:

- Use GST-capable accounting software and enable e-invoicing where applicable.

- Reconcile purchase invoices with GSTR-2B and GSTR-2A to avoid ITC denial.

- Maintain documentation for export, RCM (reverse charge mechanism) and zero-rated supplies.

- Train staff and outsource complex filings to qualified professionals to maintain consistent GST Compliance.

Long-term Economic Effects

Over the long run, GST contributes to formalization of the economy, higher direct and indirect tax compliance, and smoother logistics. It also makes India a more attractive destination for investment by reducing tax fragmentation and improving ease of doing business metrics.

Conclusion

GST has been a landmark reform that replaced a fragmented indirect tax system with a single, value-added regime. While it introduced compliance and technology challenges, its benefits — greater transparency, reduced cascading taxes, improved supply chain efficiency and a more formal economy — are substantial. Businesses that invest in good systems, strong reconciliation processes and proper training will continue to gain the most from the GST framework.

Need help with GST compliance or strategy?

Our tax consultants can assist with registration, return filing, e-invoicing setup, ITC reconciliation, and audits.